Buying a home can be an amazing and fun experience, or it can be frustrating and stressful. Stay tuned for our top five smartest tips for buying a home ????

Hi I’m Mike Regan. Before I got into real estate, I was a process improvement consultant and the author of two books on the subject. Then, as a top-producing real estate agent, I was blessed to personally sell over 750 homes in my 17-year career. Now, as the founder and CEO of Relevate Real Estate, I lead our team in continuous collaborative projects to improve the residential real estate process for our buyer and seller clients.

In this blog post I’ll share five smart tips about your financing, whether or not you should use an agent, when you should start your search, what criteria you shouldn’t leave out of your search parameters, and finally why you should take a walk before you make an offer.

Tip #1 is…

1. Get Your Financing Figured Out

Before you know what homes to consider, you need to know how much you can afford, and that comes down to the monthly payment amount. Between loan products and new lending rules, variable interest rates and credit score surprises, most buyers are looking in the wrong price range (too high or too low). Ask your real estate broker for a referral to a mortgage lending specialist with at least five years’ experience. Based on your preferred monthly payment, income, and credit scores, they will review all your loan and down-payment options and write you a “pre-qualification letter” stating what purchase price you can afford.

The seller’s agent will need this letter before they can consider your offer. A “pre-approval letter” (as opposed to a pre-qualification letter) requires much more labor on your part to provide additional paperwork and verification, but since listing agents don’t care about this at all, it will not help you at all when making an offer on a home, so skip it. The listing agent will either trust the reputation of your agent who is making the offer, OR if they have any real concern, they’ll ask permission to talk to your lender, which you should grant.

You will get the best advice and rates from a mortgage broker who specializes in residential loans, and has access to a large variety of loan products. Loan officers who work for one of the big banks, such as Wells Fargo and Bank of America, tend to focus exclusively on their own products. Retail bank locations are busy with a wide variety of services such as checking, savings, business and auto loans, and normally offer limited lending options, so they are rarely competitive. One exception is the State Employees Credit Union. If you are a member, you should definitely talk to them about your purchase.

Shop for the best rate for your family, but think twice about switching away from a lender who invested their time to give you advice and help, just to save an eighth of a point. Anyone can quote you a lower rate, but that lender may drop the ball later and cost you money or delay your closing. Do not use internet lenders, out-of-state lenders, or any lender who was not referred to you, unless you like surprise rate hikes the day before your closing, when it is too late to react.

A great mortgage broker can sometimes even lower your rate after you lock it in, by moving you to a different lender if the rates go down before closing. The best brokers will call and offer it without you having to ask. You will only find that kind of broker by referral.

Finally, when your mortgage broker asks for additional paperwork, get it to them immediately. They cannot control what the underwriter will ask for or when, and if you are late delivering the paperwork, your closing might be late also.

My second tip is…

2. Use a Real Estate Agent

Yeah, okay, I’m a real estate agent and I hang out with a lot of real estate agents. But here’s why I’m suggesting that you use a real estate agent when you buy…

As a buyer, the commission for your agent is paid by the firm that lists the home you end up buying. So YOU don’t pay any commissions when you use an agent to help you.

In addition, a good real estate agent will help you find the right home in the right area, guide you away from big mistakes, and negotiate a better deal for you. Some buyers think they will save money by not having an agent. Think again. The seller has agreed to pay a certain commission rate to the listing agent, regardless of whether the buyer is represented or not. If you don’t have an agent, the listing agent will keep the entire amount, and you will miss out on the benefit of professional advice.

Beware of agents who offer you part of their commission as a “buyer rebate.” This may be a sign they are struggling to survive as a real estate agent, or doubt their own value, and as a result may not be competent to represent you.

Tip #3 is to …

3. Start Early

Most buyers purchase a home that doesn’t fully match their original criteria, because their criteria evolves and changes as they look at homes. If you start looking too late, you might buy the wrong home, because you haven’t had that time to think. It makes sense to start looking and exploring long before you are ready to buy, to give yourself time to learn and think about what you see. A good agent will be patient and will prioritize YOUR needs and timeline above any other interests. Meet with that good real estate agent and tell them your criteria. Then look at a map and ask them what areas are appreciating in value, and what areas to avoid.

Your broker will start sending you properties by email. Sort through them and pick the ones you like the most. When you have time, drive by these homes and see what you think about the neighborhood and the commute to work. By doing this and taking your time, you’ll find neighborhoods you never knew existed. You have to decide what geographic area you want to live in before you decide which specific home you want to purchase. The right house in the wrong area, is the wrong house, right? At this stage you are trying to figure out the right area.

Continue to look for homes on Realtor.com and Zillow as well as on the search page on your broker’s web site. You’ll end up finding homes you like that do actually meet your original criteria. No problem. That’s the whole point. Tell your agent about these, change your criteria if you want to, and they’ll send you more homes to consider.

If you see a home in the middle of all this that you absolutely love, call your agent and tell them you want to see it ASAP. No harm in looking, and if it is the perfect home, maybe it makes sense to move a little earlier than you planned.

Tip #4 is to…

4. Know Your Criteria

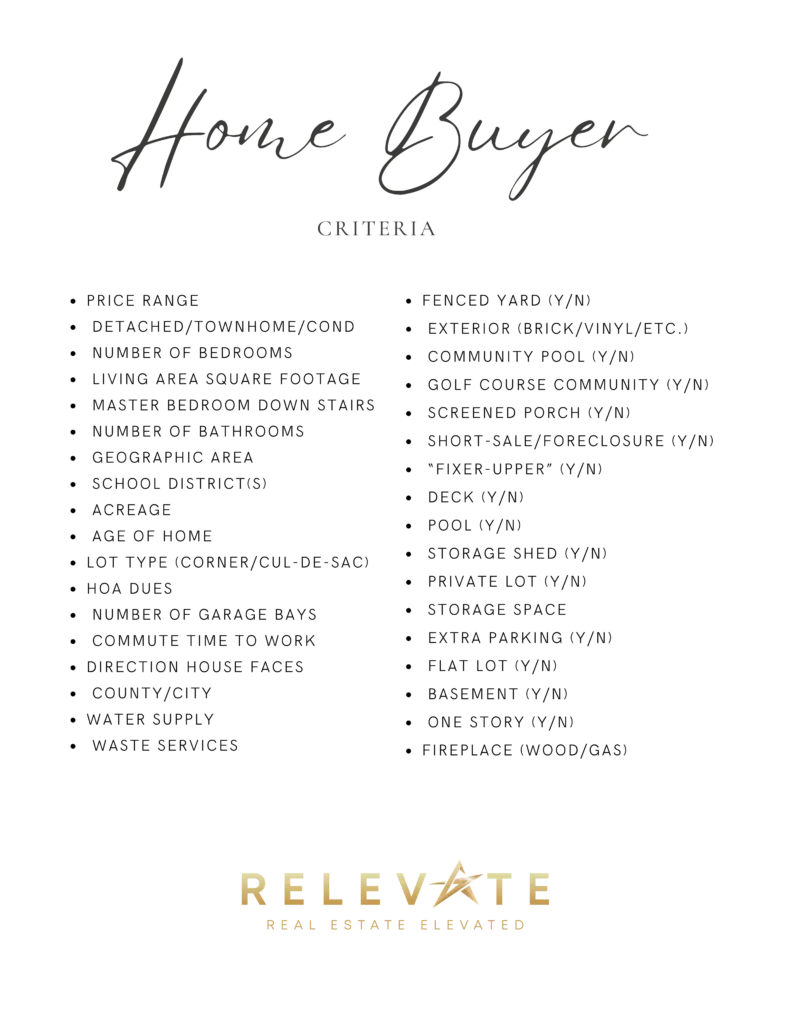

It’s common to forget a criteria that ends up being really important to you later. Better to think about it early on and have it on your list. Here is a solid list of criteria for you to consider.

Tell your real estate agent everything you want in your next home. If your search results in too many homes to choose from, you can add to your criteria to narrow it down. If not enough homes match your criteria, you can make your criteria less specific.

Finally, tip #5…

5. Walk the Neighborhood Before Making an Offer

Before committing to purchasing a home, take a few slow walks through the neighborhood at different times of day. Listen for barking dogs. Look for children playing if that is important to you (because the law prohibits your agent from discussing anything related to “familial status”, even whether there are kids in a neighborhood). Introduce yourself to a few neighbors. Tell them which home you are thinking about, and ask them what they know. Neighbors love to talk and you might be glad you listened.

CONCLUSION

So there you have it, our five top tips for buying a home that will help you have a great experience instead of being stressed out and sad. And, while I was talking, I actually thought of five MORE top tips for buying a home that I think could be helpful to you as well. Read part two here.

You may have other questions as well, for example, “How should I manage the timing of selling and buying at the same time?” or “What is the best way to make an offer on a home that’s obviously overpriced?” Jump into our Learning Center for articles about these and many other topics.

Relevate Real Estate isn’t right for everyone, but if you’re thinking about selling or buying or know someone else who is, we are never too busy for you or your referrals to your family, friends, neighbors, and co-workers. If you already know a Relevate agent just give them a call and they’ll be happy to help. If you don’t already have a relationship with one of our agents, or if you live in an area where Relevate isn’t (yet), just send an email to me at mike@relevate.life and I’ll be glad to introduce you one of our best agents, or a great agent from our network in your area of the country.